Ecosystem

To solve current problems, limiting the possibilities of cryptocurrency market participants, limiting the use of cryptocurrencies, and as a result, impeding the development of the cryptoasset market as a whole, an innovative and comprehensive solution is necessary.

Such will be the Neluns solutions – an innovative financial ecosystem of the future.

The Neluns ecosystem includes:

- Neluns Bank – A new generation bank, presenting all key fiat banking services with cryptocurrencies.

- Neluns Exchange – An Innovative cryptocurrency exchange, making secure and fast cryptocurrency trade operations of any scale available.

- Neluns Insurance – Insurance company, allowing to protect any transactions and trades executed by ecosystem users.

The Neluns team abides by the principles of simplicity and minimal risks. We are developing the best system, taking into account the shortcomings of existing solutions and introducing new innovative ideas to modern technologies.

Neluns Bank

The first element of the ecosystem is the Neluns Bank. Which is a licensed commercial bank, officially registered in accordance with all regulatory requirements.

The Neluns Bank presents a broad spectrum of services for physical and legal entities. While all operations are available in fiat and in cryptocurrencies.

During the first stage, Neluns Bank will carry out activities combining classical banking and banking on the Blockchain. In the future, Neluns Bank, together with its partners, will transition to its own Blockchain for international settlement purposes.

The utilization of leading technologies allows us to create financial products, access to which will be available around the clock from any part of the world.

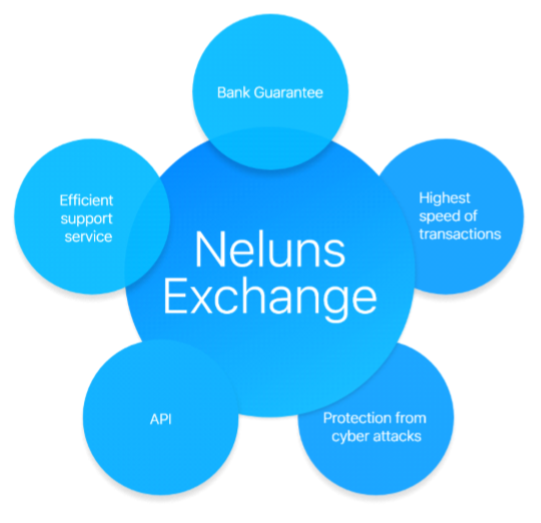

Neluns Exchange

The Neluns Exchange strive to become a global cryptocurrency exchange and establish itself as the foundation for a new and complex banking architecture, which does not suffer from the shortcomings of the existing system. We are creating an innovative solution, eliminating the drawbacks of existing cryptocurrency exchanges.

Neluns Insurance

A separate element of the Neluns financial ecosystem, is the insurance company – Neluns Insurance. On demand of the bank and cryptocurrency exchange users, it will carry out insurance coverage for financial risks, tied to trades and transactions.

Ecosystem users will have access to full and partial risk insurance.

- Full insurance. Provides insurance coverage in full when an insured event occurs.

- Partial insurance. Limits insurance coverage as certain insurance amounts, as well as the system of specific insured event occurrence conditions.

The base insurance premium amount with full coverage comprises 10% from the total trade/transaction sum. It can change depending on a row of criteria. The cost of partial coverage is determined individually for each specific case.

After the insurance payment is paid, the claim right of the defaulting party is transferred from the insured to the insurer.

Clients will have access to the following insurance services:

- Risk insurance for defaulting counterparties when executing transactions. • Insurance in case of unforeseen circumstances during transactions.

As the ecosystem develops, the set of insurance products will be expanded. The following services will be added to the basic services:

- Insurance of credit and deposit risks.

- Insurance of investment risks.

- Insurance of financial guarantees.

Neluns Advantages

Broad spectrum of banking products.

With the emergence of Neluns, the possibilities of cryptocurrency market participants will significantly expand. Each of them will be able to find an optimal solution amongst a broad spectrum of banking products. For example, long-term investors can extract additional profits on account of deposit placements, traders and cryptofunds can expand their abilities on account of access to lending tools.

The Peer-to-Peer (P2P) Lending Platform opens up access to cryptocurrency loans for a broad range of individuals. The escrow system will allow to increase ICO investment security levels, which will result in a growth of investor confidence, and thus, the volume of attracted funds.

Unique cryptocurrency exchange

The Neluns Exchange is not just another cryptocurrency exchange, but a radically different structure, free from the issues of existing cryptocurrency exchanges. The use of the “bank guarantee” approach protects assets from unforeseen circumstances. The use of leading technologies from two financial worlds allows for the creation of a secure system, capable of handling millions of transactions per minute.

Users that pass verification will be able to carry out transactions of any scale, and fund withdrawals to multicurrency Neluns Bank accounts will occur near instantaneously. Around the clock support services will quickly resolve all user issues.

High level of security

The presence of a traditional financial institute as the base of Neluns will significantly improve security. We are integrating the best solutions from global companies, which develop software for the world’s largest banks. Aside from this, Neluns client assets are legally protected.

The Neluns Insurance company provides clients with the opportunity to insure trade and transactions. This allows for losses to be compensated in the case of an insurance event.

Elimination of entry barriers

The emergence of the Neluns ecosystem will significantly simplify the entrance of new participants into the cryptocurrency market. We are realizing familiar banking products. Clients will be able to purchase cryptocurrencies and carry out transactions in just a few clicks. Moreover, Neluns realizes the ability to pay for goods and services with cryptocurrencies, and companies will receive payments to their merchant accounts.

Ability to make instant payments anywhere in the world

The Neluns Bank provides any individual or company to carry out cryptocurrency transactions from any part of the world with minimal transaction fees.

A user can top up an account or withdraw funds anywhere in the world, in order to do so, an ATM must be used or a transfer needs to be made.

Low commissions with minimal risks

Neluns is constructing the ecosystem in accordance with the BaaS concept. The Neluns iOS and Android applications with a user-friendly interface open up access to all cryptocurrency and fiat banking products, around the clock.

The absence of a network of branches and affiliates makes it possible to reduce transactional costs many times over, and the use of leading technologies makes them even smaller, increases security, and operating speeds. The use of Visa, MasterCard, and American Express partner network ATM’s will allow for instant cash withdrawals.

As a result, Neluns offers its clients, both private and corporate, a broad spectrum of familiar services at the most favorable terms. This will allow us to attract a huge quantity of new participants to the cryptocurrency market, broaden the applicable uses of cryptocurrencies, as well as organize an impressive inflow of capital into the cryptocurrency market.

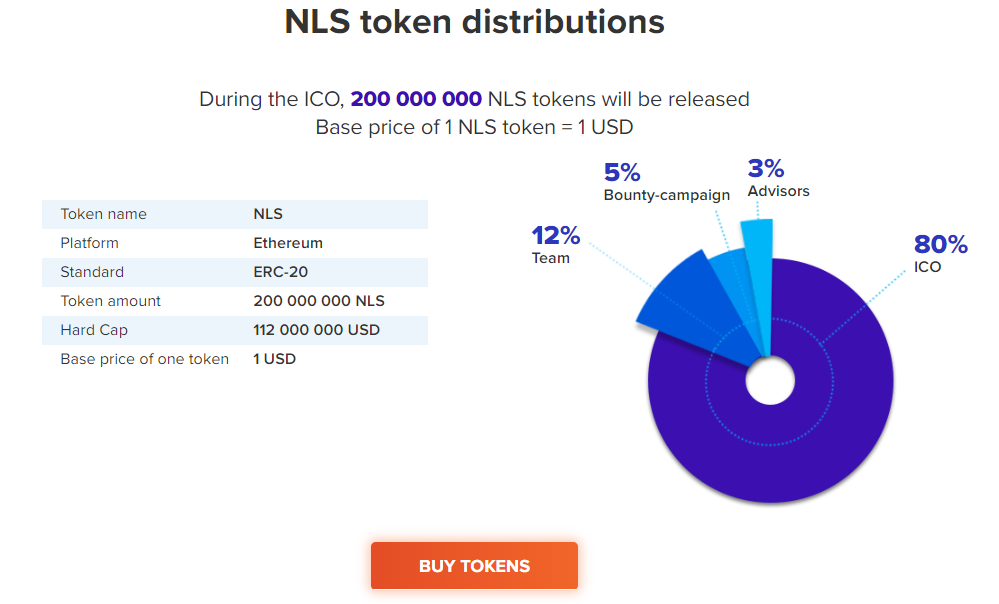

Neluns ICO

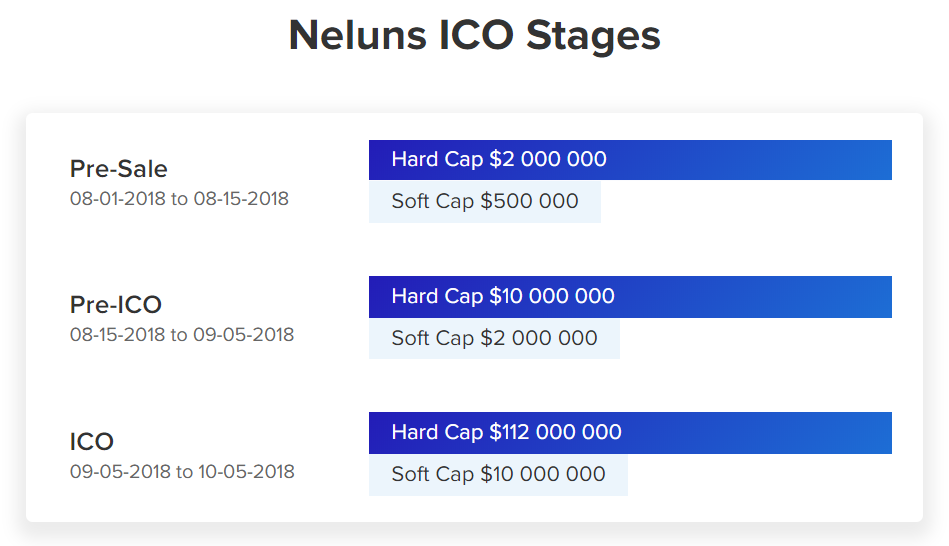

Stages (rounds) ICO

Pre-Sale

Hard Cap – $2.000.000

Soft Cap – $500.000

1 stage (round), pre-sale, stage (round) length 14 days,

from 08-01-2018 to 08-15-2018.

Pre-ICO

Hard Cap – $10.000.000

Soft Cap – $2.000.000

2 stage (round), pre-ICO, stage (round) length 21 days,

from 08-15-2018 to 09-05-2018.

ICO

Hard Cap – $112.000.000

Soft Cap – $10.000.000

3 stage (round), ICO, stage (round) length 31 days,

from 09-05-2018 to 10-05-2018.

Mobile application for iOS and Android

Applications for iOS and Android will make it easy to transfer, exchange operations, receiving and giving out loans in fiat and cryptocurrencies (p2p-crediting) just in two clicks.

The iOS and Android applications will allow you to make all possible trade operations within the Neluns ecosystem: buy and sell cryptocurrencies on the Neluns Exchange in one click, make an interest receiving deposit in the Neluns Bank, receive a loan from the Neluns Bank, provide or receive a loan on the P2P-platform, make transactions anywhere in the world in a matter of seconds.

The pictures below demonstrate how the iOS and Android applications work.

RoadMap :

November 2017 : Neluns team Formulation

December 2017 : ICO preparations

May 2018 : IOS mobile application beta testing

June 2018 : Holding of a closed investment round for investment funds and anchor investors

July 2018 : Preparations for the NLS token sale

August 2018 : Pre-sale of NLS tokens, pre-ICO

September 2018 : NLS token ICO, mobile application launch (beta version) for iOS and Android

October 2018 : Listing on the cryptocurrency exchange bittrex.com, huobi.com, kraken.com

November 2018 : Launch of the p2p lending platform, launch of mobile applications (alpha version) for iOS and Android

December 2018 : Listing on the cryptocurrency exchange hitbtc.com, poloniex.com, binance.com, bitfinex.com, okex.com

January 2019 : Obtaining a license for Neluns Bank, launch of a payment service for converting cryptocurrencies and executing the transfer of funds to any part of the world, connecting Neluns Bank to Swift, start of Visa, MasterCard, American Express bankcard issuance

February 2019 : Obtaining a CFTC license and launching the Neluns Exchange — an innovative cryptocurrency exchange

April 2019 : Launch of the full-fledged Neluns ecosystem

April 2020 : IPO (initial public offering) on the New York Stock Exchange (NYSE)

WEBSITE: https://neluns.io/

TWITTER: https : //twitter.com/TheNeluns

TELEGRAM: https://t.me/TheNelunsChannel

ETH ADDRESS: 0x23a1cd7e56C6cbeA5103d66CfeC0A08B3e4ED8c9

0 komentar:

Posting Komentar